tesla tax credit 2021 colorado

EV Federal Tax Credit for 2021 Tesla I purchased my Tesla Model Y in late Feb. For buyers who are eager to purchase an electric vehicle.

Most Popular Electric Vehicles Don T Qualify For Texas Ev Rebate Program Texas Thecentersquare Com

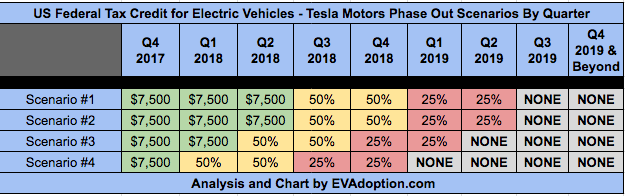

The table below outlines the tax credits for qualifying vehicles.

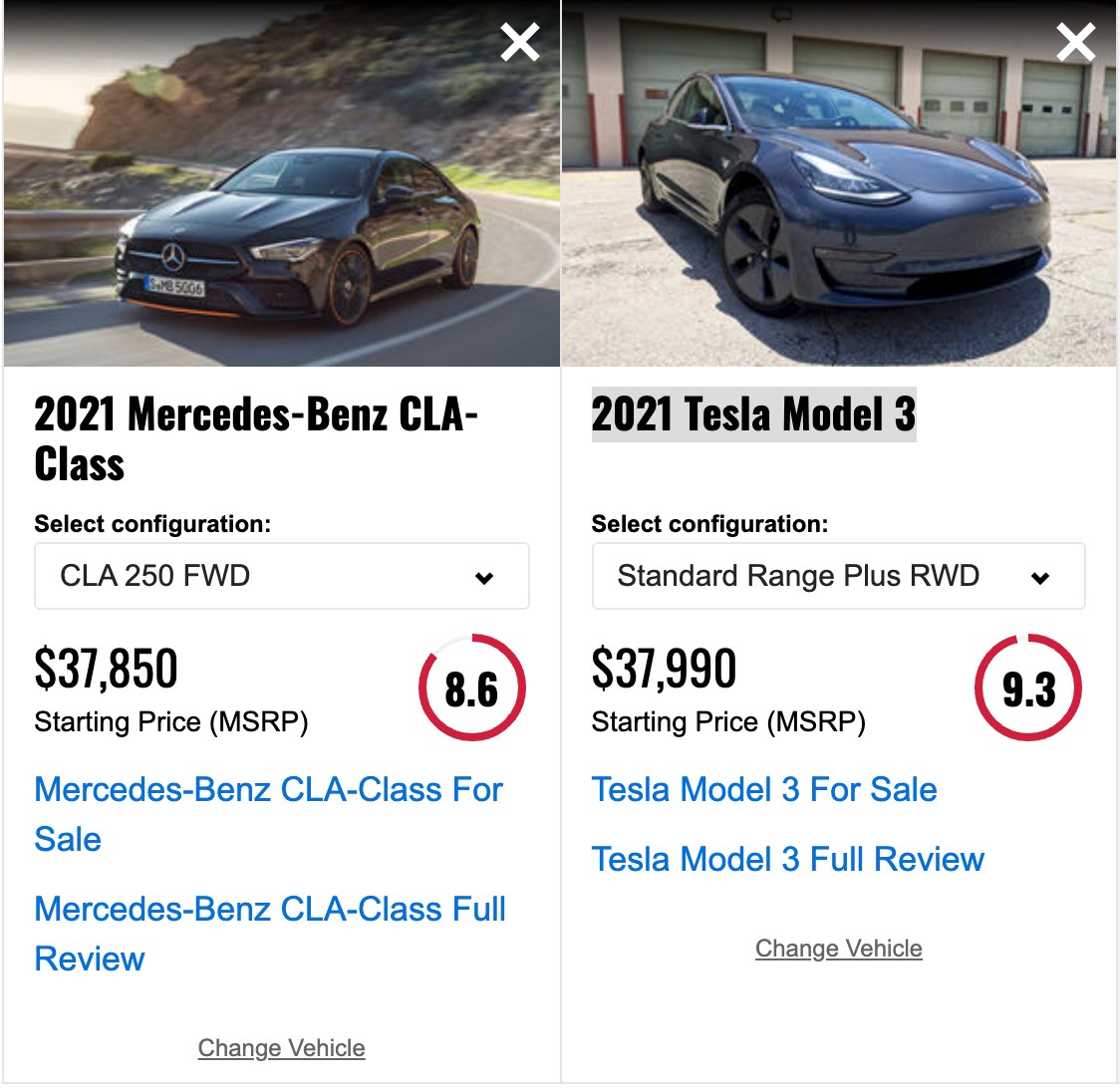

. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. A refundable tax credit is not a point of purchase rebate. The Tesla Model 3 is one of the worlds best-selling electric vehicles but does it qualify for a federal tax creditThe Model 3 expertly blends performance with affordability with.

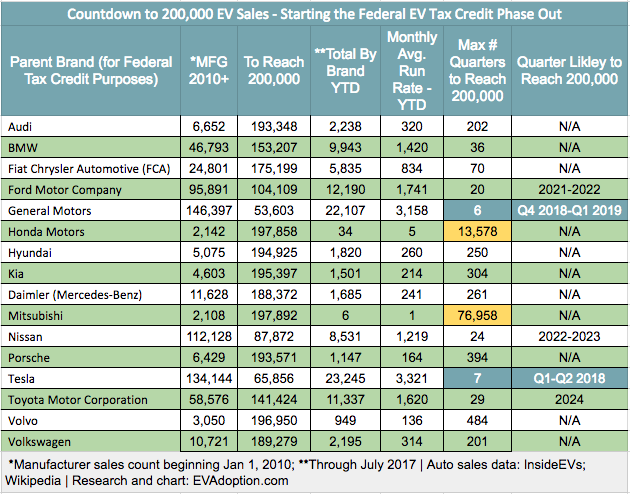

The credits decrease every. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. March 14 2022 528 AM.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Tesla is installing Tesla. The credit is refundable.

The tax credit also isnt available for those with a taxable income higher than 150000 or 300000 if filing jointly. You do not need to login to Revenue Online to File. Any vehicles purchased after that date are no.

Some dealers offer this at point of sale. To the extent that the amount of the credit exceeds tax the excess credit is refunded to the taxpayer. 1 Best answer.

Standalone Powerwall Residential Federal Investment Tax Credit For Systems Installed In. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased. The effective date for this is after December 31 2021.

Based on the Model 3 sedan the Tesla Model Y is a battery electric. Registered in Colorado to qualify for the credit. One Tesla that should qualify for the federal Clean Vehicle Tax Credit in 2023 is the Tesla Model 3 which would have been the Model E if Ford hadnt snapped up the snappy.

The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. The Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit. You may use the Departments free e-file service Revenue Online to file your state income tax.

The incentive amount is equivalent to a percentage of the eligible costs. Save time and file online. Tesla buyers may be able to take advantage of new federal tax credits for electric vehicles next year the.

Light duty electric trucks have a gross. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Published 147 PM EDT Thu October 20 2022.

Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data. The second document made further changes. Contact the Colorado Department of Revenue at 3032387378.

Electric Vehicle Resources And Information Boulder County

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Tesla S 7 000 Ev Incentive Is A Nail In The Coffin For Ice Competitors

Today The Federal Tax Credit For Tesla Decreased To 1 875

Tax Credits Drive Electric Northern Colorado

Tesla And Gm Evs To Gain Access To New 7 000 Tax Credit Youtube

Tesla Increases Model Y Prices Again As New Incentives Are Coming Electrek

Tesla Ev Tax Credits Run Out At The End Of 2019 And Prices Rise

Tesla Ev Tax Credits Run Out At The End Of 2019 And Prices Rise

Tesla Model 3 Us Federal Ev Tax Credit Update Cleantechnica

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

Tax Credits Drive Electric Northern Colorado

Like Gm And Tesla Toyota Running Out Of Ev Tax Credits

Can You Really Shave 25 000 Off The Price Of An Electric Car

Used Electric In Colorado Springs Co For Sale

New Ev Adoption Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption